The crypto market is witnessing the “throne” of many derivative exchanges as the demand for trading derivative products of brothers continuously grows.

Prominent among them is the FTX exchange – an exchange that focuses on derivative products. What are the advantages of FTX? Compared to competitors such as Binance Futures, SnapEX, and Huobi DM, what is the difference between FTX?

What is FTX?

FTX is an exchange that provides derivative products related to cryptocurrencies such as Futures Contracts (future contracts), Spot (instant trading), Option (options trading), OTC, and Leveraged Tokens ( Margins).

FTX is increasingly asserting its position in the cryptocurrency exchange market, proof of this is the constantly increasing daily trading volume on FTX. This is pretty impressive given that the platform is quite young and, in fact, FTX isn't available to anyone based in the US.

FTX Development Team

Behind FTX ‘s success is a team with a wealth of experience in the cryptocurrency market, from the top quantum and tech companies on Wall Street – Jane Street, Susquehanna, Optiver, Google, and Facebook.

- Sam Bankman-Fried – CEO & Founder: He is a crypto superstar. The 29-year-old billionaire co-founded Alameda Research with Gary Wang in 2017. Two years later the pair launched FTX. Previously, Sam was a trader on Jane Street Capital's international ETF desk. Sam has traded a variety of ETFs, currencies, stocks, and commercial contracts, and he also designed an automated OTC trading system.

- Gary Wang: CTO & Founder: Before founding FTX, Gary was a software engineer at Google. He built systems to aggregate prices on millions of flights, reducing latency and memory usage by more than 50%.

Nishad Singh – Head of Engineering: He used to be a software engineer at Facebook. He graduated with honors from the University of California Berkeley with bachelor's degrees in electrical engineering and computer science. - Jen Chan – Chief of Staff: She used to be Head of the Hong Kong office at Alter Domus. She graduated from Hong Kong University of Science and Technology with a BA in accounting and is a CPA.

Dan Friedberg – Regulatory Officer: Dan was an associate at Fenwick & West LLP. There, Dan led the crypto operation and was president of the Payment Systems team. - Can Sun – General Counsel: Serve as co-chair of the Blockchain practice group at Fenwick & West LLP?

- Alameda Research: founded in October 2017, is a venture capital fund. To date, the fund has managed over $100 million in crypto-assets and has a daily trading volume of $600 million to $1.5 billion. It is known that Alameda Research is also the main supporter of FTX.

Goals of FTX

FTX is committed to bringing the best derivatives exchange to users, by:

- Dealing with problems that futures exchanges often face: poor quality products, system overload, lack of liquidity, revenues, etc.

- Build and develop more new products to meet the increasing needs of users

- Listen, resolve customer feedback quickly

Some basic information about FTX

- Release date: April 2019.

- Exchange token: FTT Token

- Headquarter: Hong Kong

- Owner: Sam Bankman-Fried

- Products: Leveraged Tokens (Leveraged Tokens), Spot (spot contracts), OTC, Prediction, Staking, Option, Futures (Futures).

July 20, 2021: FTX successfully raised capital with an amount of up to 900 million USD, then FTX was valued at 18 billion USD.

August 31, 2021: FTX acquires LedgerX – a US-licensed derivatives company that serves both institutional and retail investors. Acquiring LedgerX will help FTX bring crypto derivatives to customers in the United States.

How to remove fees on FTX

Trading fees on FTX

FTX has a tiered transaction fee structure, details are shown in the table below:

Besides, FTX also has a discount policy for FTT holders.

Discount policy for FTT

Deposit/withdrawal fee on FTX

Currently, you do not have to pay fees when depositing/withdrawing coins on the FTX exchange. Maybe this is a strategy that FTX implements to attract a large number of users. In the future, the exchange may charge a withdrawal fee.

Other fees: FTX is having a lot of incentives on fees:

- No OTC transaction fees

- Use a margin of 50 times or more, an additional transaction fee of 0.05%.

- Tokens used have a creation and redemption fee of 0.1%, a daily management fee of 0.03%

The pros and cons of FTX

Advantages

- Provide a variety of products, relatively fully meet the needs of users

Deposit/withdraw coins without fees - There is an API gateway that makes it easy for users to link the exchange's account with trading bots or portfolio apps

- There is FTT token, which is growing tremendously since its inception

- Never been hacked

- When staking FTT receives many benefits, notably free sending ERC-20 tokens.

- Built-in sub-account feature, convenient when dividing portfolio

- Provide sufficient API Key for users who want to use 3rd party tools for transactions.

Defect

- If the market has a strong chance, the Exchange is sometimes a bit laggy

- Some users rated the interface on the computer as not beautiful

- The transaction history is not displayed in detail.

How to register an account on the FTX exchange

In order for the account registration to not take too much time, you should prepare a few things as follows: https://ftx.com/

- A commonly used email address.

- Photo of the front and back of the ID card, 1 selfie photo with the front of the ID card. You can use your driver's license or ID card to replace your ID card.

- Pre-install the Google Authenticator app on your phone.

Register for an account on FTX

- You can access the website of the FTX exchange here.

- Then you enter Email and Password => Select Click to Verify

Note: You must type directly, not copy-paste. The password must satisfy 2 conditions:

- Contains at least 1 special character (# @ % $ ! * & ^).

- Have at least 1 uppercase and 1 lowercase character.

You drag and slide the circle so that the puzzle piece above matches the empty square.

Then select I agree to the FTX Terms of Service. Finally, select Sign Up.

You have successfully registered a trading account on the FTX exchange. Very simple, isn't it? From now on you can withdraw 1000 USD/day.

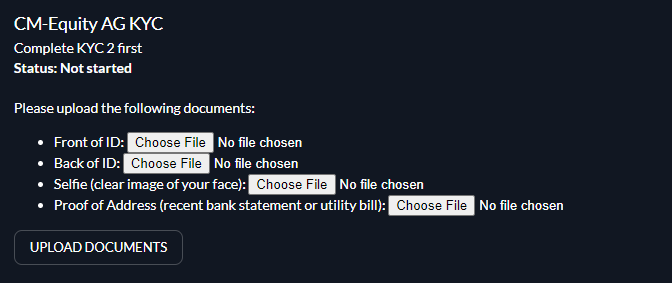

Verify KYC identity

KYC is an acronym for Know Your Customer, which is the process of collecting necessary data for identification, including portrait photo, address, Passport, identity card number, etc.

KYC identity verification will help limit impostors, remove unqualified people from using certain services.

After successfully logging in, see and select the SETTING icon as shown below. The interface will appear 2 requests that need you to authenticate:

- Identity Verification: You need to verify your identity to send money or make a transaction.

- CM-Equity AG KYC: 2 steps KYC verification – you need to upload documents to do the verification.

Select Enable Trading and Deposits to verify your identity. You fill in enough information to verify Level 1, including:

- Verification Type: Organizational or individual account.

- Full name: Full name.

- Country of residency: Country of residence.

- State, province, or region: The state, province, or region in which you live.

- Optional information: Favorite chat app, chat handle.

Completing the level 1 verification, you can withdraw the amount from 2000 USD to 9000 USD per day.

After completing the information, select Submit Information to switch to Level 2 verification with the following information:

- Full legal male: Full legal name

- Country of residency: Country of residence

- Source of funds: Source of funds – you can choose Trading (trading) or Income (income). If you select Other (other), you must specify the source of your personal assets, business or residential address.

Press Start to continue. Select the Country/Region of issue and type of ID

Then, you upload the ID photo to the system by phone ( Continue on mobile ) or computer webcam ( Take a photo using a webcam ), including:

Next, you enter the Residential Address including the specific address where you live.

You also need to verify the phone number by entering the phone number, selecting Request SMS Code, entering the 6-digit code that has just been sent to the phone. When done, scroll down and select Submit Information.

You also need to add the necessary documents, click Upload Additional Documents.

Select Proof odd Address, this is proof of your address verification, you can take a photo of your bank statement, utility bill, or ID card including your address, etc. You upload and select Upload.

Enable 2-step security 2FA

This step will help you increase your security, which is what almost every crypto trader does to ensure the safety of his account.

You select the icon SETTING => Security => Two-Factor Authentication =>> Authy/ Google Authenticator.

Note: In this step, you need to download the Google Authenticator or Authy app to your device first to scan the code and save the 16-digit string for backup.

You can choose a security method by SMS. But I find this method quite time-consuming because of waiting for messages or complicated when changing sims.

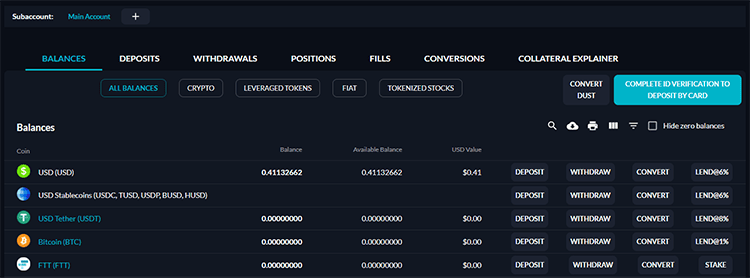

How to deposit/withdraw and trade on FTX

Deposit on FTX

- From the FTX homepage, select Wallet in the upper right corner of the screen.

- Enter the token of the coin you want to send in the search box. For example BTC, you enter BTC and select Deposit. You do the same with the other coins.

- Next, you deposit BTC into the wallet address displayed.

Note: Remember to send to the correct wallet address of that coin, do not send coins to other storage wallets.

Withdraw on FTX

This step is also quite simple, almost similar to the deposit steps. However, you will choose “ Withdraw ” instead of “ Deposit ”.

Next, enter your wallet address in the “ Address ” box and enter the amount to withdraw in the “ Amount ” box. Finally, select ” Withdraw ” and you're done.

Experience when trading on FTX

- The transaction amount cannot be more than the available balance in the account.

- Order maintenance fee.

- Each coin will have different leverage.

- Make sure you always use Stop-Limit to minimize your risk.

- Distinguish and understand MOVE Contracts and Futures Contracts.

Orders to know when trading on FTX

- Limit Order – Limit Order: This order allows the user to manually set the desired buy/sell price. Limit Orders are executed only when the market price reaches the previously set limit price.

- Market Oder – Market order: This allows you to buy assets at the time of placing the order.

- Stop Limit – Stop limit order: The order has 2 prices, the limit price (Limit) and the stop price (Stop). When the price reaches the stop price, the limit order will be pushed to the order book and wait for execution.

- Trailing Stop: This allows you to stop loss flexibly.

- Stop Market – Stop market order: The order has 2 prices: the stop price (stop) and the market price (Market). When the price hits the stop price, the market order will be filled immediately.

Instructions for trading on the FTX exchange

Trade Future on FTX

Futures are futures contract trading. This is a purchase and sale agreement between a buyer and a seller at a specified time in the future.

You follow these steps:

- On the main screen, select “ FUTURES ”, then select the contract you want to trade. Here is an example of a BTC-PERP coin.

- This trade is quite similar to the Spot (spot) trade. However, the difference is that you don't need to hold the exact asset class, but just the corresponding collateral Collateral, trading on its index.

Trade Margin on FTX

FTX allows you to trade leverage with ratios 1x, 3x, 5x, 10x, 20x. You can only margin trade with USD. This means you deposit USD to buy other coins or sell coins to get USD.

You follow these steps to trade margin

- Select “ Leveraged Tokens ” to convert the coins you are holding to USD.

- Select leverage to filter these leveraged assets.

- Then, you scroll down to see the place to buy and sell these tokens, however, you must deposit USD before, otherwise the word ” DEPOSIT USD ” will be displayed.

Instructions for placing Stop-Limit orders

To place a Stop-Limit order, you must determine the starting price of the trade. Specifically, you must enter the trigger price directly when creating a Stop-Limit order.

- If you are buying, an order book will be sent when the market price exceeds your trigger price.

- If selling, the order book will be sent when the market price falls below your trigger price.

For example, BTC-PERP is at $10,000. You buy Stop-Limit with the trigger price of $10.5 and size 5. When the market goes up to $10.5, the Stop-Limit order will be triggered and FTX turns it into a 5 BTC-PERP buy order.

Frequently asked questions about FTX Exchange

What to do when you lose 2FA

If you still keep the 16-digit key at the time of setup, enter the key into the Google Authenticator app, the system will issue you a new code.

If you no longer have the 16-digit key, you need to contact FTX support:

- Email: support@ftx.com

- Telegram: https://t.me/FTX_Official

Has the FTX exchange been hacked?

Since its launch, the FTX exchange has never been hacked.

What is the deposit and withdrawal limit?

- Deposit: no limit

- Withdrawal: If you have not verified KYC, the limit is 2000USD/day. If the verification is successful, the withdrawal is unlimited.

Conclude

Above is information about the FTX Exchange as well as how to create an account on the Exchange that Review Invest wants to share with you.

It can be seen that FTX is an exchange that meets the needs of trading from basic to advanced levels, especially Crypto derivatives trading.

Hope this article will be useful to you. And do not forget to follow the next articles to update the latest information about the Crypto market.